Antiques as a safe haven

In a historical moment characterized by great economic uncertainty and the market crisis, the purchase of antiques goes against the trend.

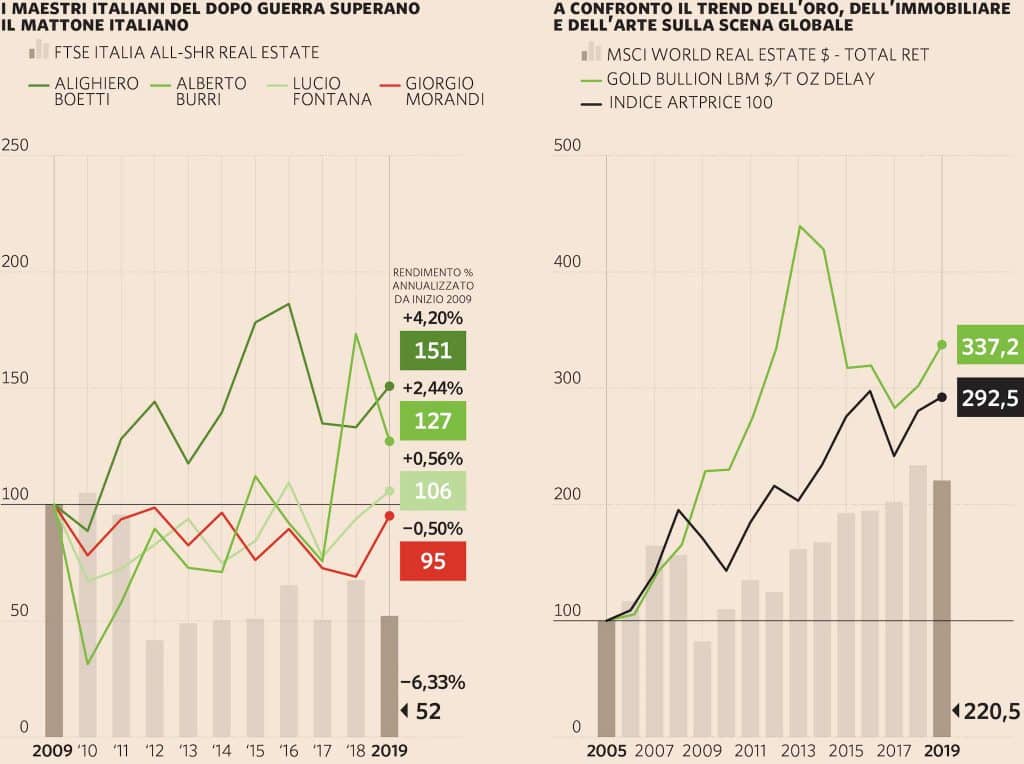

As emerges from an Artprice.com research taken up by Il Sole 24 ore (Italian business newspaper), art has been shown to react to the crisis in a much better way than the real estate market, and the comparison with the gold trend also proves an alignment with this over the past four years.

If initially art was intended as an asset in which the buyer could take refuge from the problems of the fluctuating financial market, in recent years it has instead been perceived as a real strategic objective in which to invest, as it is considered among the safest assets. and above all more profitable.

This is what emerges from the annual reports on art and finance, signed by the Art & Finance division of Deloitte.

In those of 2017 and 2018, in fact, an increasing number of stakeholders were registered (stakeholders, editor’s note), such as enthusiasts and collectors, operators and simple investors.

The report highlights that 2017 was a year of considerable recovery in the art market, also thanks to the continuous expansion of the online channel.

In fact, the web guarantees investors greater availability of information and accessibility to products, and therefore allows a wider choice and diversification possibility.

In an economically negative era, art and antiques are solid alternatives for competitive investment.

The analysts of Artprice, the famous auction database, based on 3900 lots, have in fact estimated an average return on investment of + 88%, for an average ownership of 11 years. Therefore an annual progression of + 5.9% .

Even the operators in the asset management sector have seized the enormous opportunities arising from investments in the world of antiques and art.

In fact, in recent times, interest has grown in offering specific services dedicated to art to its customers.

According to the aforementioned Deloitte report of 2018, investments in art and collectibles by those with high net worth are estimated at around 1,600 billion dollars in 2016, with a forecast of 2,700 billion by 2026.

The buyers who have a high capital are not the only investors, however, the art market is in fact also accessible to small and medium-sized buyers: Nicola Maggi, journalist and historian of art criticism, estimates that around 80% of art transactions take place under 5,000 euros, and often even under 3,000.